The Social Security program is a fundamental tool in the United States to ensure the economic well-being of millions of citizens, especially retirees, people with disabilities and families who depend on this income to cover their basic needs. With decades of operation, this system has proven to be a key support in the face of economic hardship and a reliable resource for those in need of financial stability.

Social Security not only provides monthly payments, but also adjusts its benefits each year based on economic factors, such as inflation. This ensures that beneficiaries maintain their purchasing power over time. In addition, its structure includes different forms of support, such as Supplemental Security Income (SSI) and disability payments, which provide additional help to those in more vulnerable situations.

Looking ahead to 2025, it is important to take into account certain changes and adjustments to the program, such as the impact of the cost-of-living adjustment (COLA) and updates to eligibility requirements for specific benefits.

Social Security payments in 2025

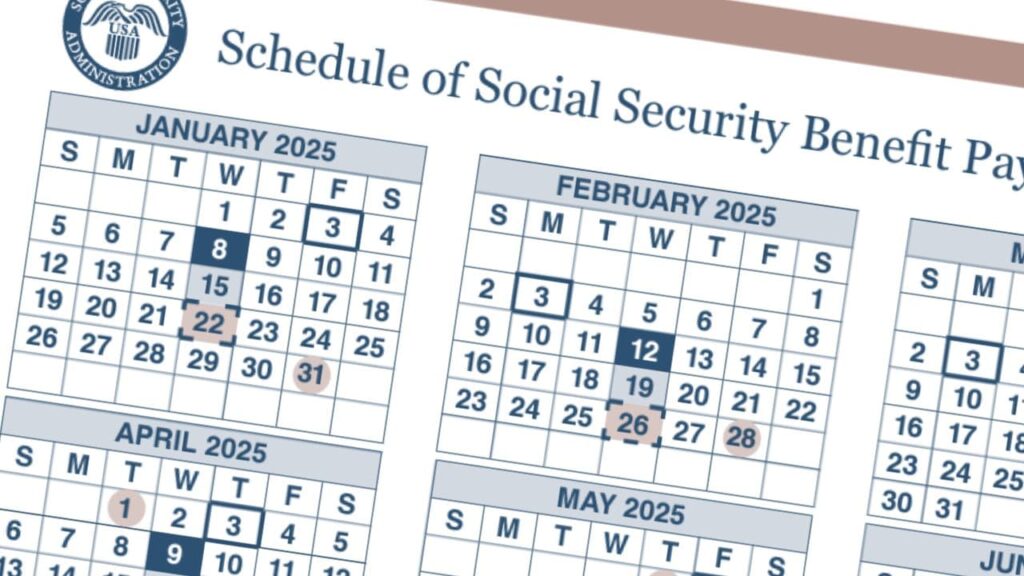

During 2025, Social Security payments will follow the usual schedule, with monthly deposits scheduled on specific days. However, as is the case each year, holidays and weekends may alter the schedule in certain cases, advancing or delaying payments depending on the circumstances.

For example, if a payment coincides with a federal holiday or falls on a Saturday or Sunday, it will be adjusted so that beneficiaries can get it early. This detail is crucial for those who plan their monthly expenses based on the arrival date of their benefits.

Thus, the full schedule for these Social Security payments in 2025 will be as follows:

| Month | Payment Date | Payment Type |

|---|---|---|

| January | Dec 31, 2024 | SSI |

| Jan 3 | Retirees before 1997 | |

| Jan 8 | Born 1st to 10th | |

| Jan 15 | Born 11th to 20th | |

| Jan 22 | Born 21st to 31st | |

| February | Jan 31 | SSI |

| Feb 3 | Retirees before 1997 | |

| Feb 12 | Born 1st to 10th | |

| Feb 19 | Born 11th to 20th | |

| Feb 26 | Born 21st to 31st | |

| March | Feb 28 | SSI |

| Mar 3 | Retirees before 1997 | |

| Mar 12 | Born 1st to 10th | |

| Mar 19 | Born 11th to 20th | |

| Mar 26 | Born 21st to 31st | |

| April | Apr 1 | SSI |

| Apr 3 | Retirees before 1997 | |

| Apr 9 | Born 1st to 10th | |

| Apr 16 | Born 11th to 20th | |

| Apr 23 | Born 21st to 31st | |

| May | May 1 | SSI |

| May 2 | Retirees before 1997 | |

| May 14 | Born 1st to 10th | |

| May 21 | Born 11th to 20th | |

| May 28 | Born 21st to 31st | |

| June | May 30 | SSI |

| Jun 3 | Retirees before 1997 | |

| Jun 11 | Born 1st to 10th | |

| Jun 18 | Born 11th to 20th | |

| Jun 25 | Born 21st to 31st | |

| July | Jul 1 | SSI |

| Jul 3 | Retirees before 1997 | |

| Jul 9 | Born 1st to 10th | |

| Jul 16 | Born 11th to 20th | |

| Jul 23 | Born 21st to 31st | |

| August | Aug 1 | SSI, Retirees before 1997 |

| Aug 13 | Born 1st to 10th | |

| Aug 20 | Born 11th to 20th | |

| Aug 27 | Born 21st to 31st | |

| September | Aug 29 | SSI |

| Sep 3 | Retirees before 1997 | |

| Sep 10 | Born 1st to 10th | |

| Sep 17 | Born 11th to 20th | |

| Sep 24 | Born 21st to 31st | |

| October | Oct 1 | SSI |

| Oct 3 | Retirees before 1997 | |

| Oct 8 | Born 1st to 10th | |

| Oct 15 | Born 11th to 20th | |

| Oct 22 | Born 21st to 31st | |

| November | Oct 31 | SSI |

| Nov 3 | Retirees before 1997 | |

| Nov 12 | Born 1st to 10th | |

| Nov 19 | Born 11th to 20th | |

| Nov 26 | Born 21st to 31st | |

| December | Dec 1 | SSI |

| Dec 3 | Retirees before 1997 | |

| Dec 10 | Born 1st to 10th | |

| Dec 17 | Born 11th to 20th | |

| Dec 24 | Born 21st to 31st | |

| Dec 31 | SSI (for January 2026) |

To ensure smooth receipt, it is highly recommended to opt for Direct Deposit, a method that guarantees timely delivery of funds to the beneficiary’s bank account. In addition to being secure, it eliminates the risks associated with sending physical checks, such as delays or misplacement.

Social Security changes in 2025

The year 2025 will also bring major adjustments to different aspects of the Social Security program, most notably the impact of COLA and updates to requirements for benefits such as SSI and disability checks.

- COLA increase. The 2025 COLA, set at 2.5%, will increase monthly benefits for all Social Security beneficiaries. This adjustment, based on the Consumer Price Index (CPI), seeks to protect purchasing power against the rising cost of goods and services. For example:

- The maximum payment for full retirement retirees will increase from $3,822 to $4,018.

- For SSI, the amounts will also increase, reaching a maximum of $967 for individuals and $1,450 for couples.

- Updated SSI eligibility. Supplemental Security Income is designed to help people with limited income, including retirees, the disabled, and children. In 2025, the general requirements will remain, but it is essential that applicants meet income and asset limits set by the Social Security Administration. These limits are adjusted periodically to reflect current economic conditions, so it is important to review updates before filing an application.

- Disability Benefits. For disability payments, the amounts will also be influenced by the COLA. In addition, eligibility requirements for this benefit include a detailed review of the applicant’s work history and the nature of his or her medical condition. The Social Security Administration conducts periodic evaluations to ensure that beneficiaries continue to meet the established criteria.

With these changes, the Social Security program will continue to be a mainstay for millions of citizens in the United States. Staying informed about updates and adjusting personal finances accordingly is key to making the most of these essential benefits.