Determining the optimal time to begin claiming Social Security is one of the most critical decisions for workers in the United States. While some experts suggest waiting until age 70 to maximize benefits, financial advisor Dave Ramsey offers a different perspective. According to Ramsey, it’s more beneficial to start collecting at age 62, a recommendation that has sparked considerable debate in the financial community.

This topic is vital for those looking to secure their financial future after years of work. While retirement benefits offer some peace of mind, it’s essential to remember that they don’t entirely replace prior income. Therefore, deciding when to start receiving these payments requires careful consideration.

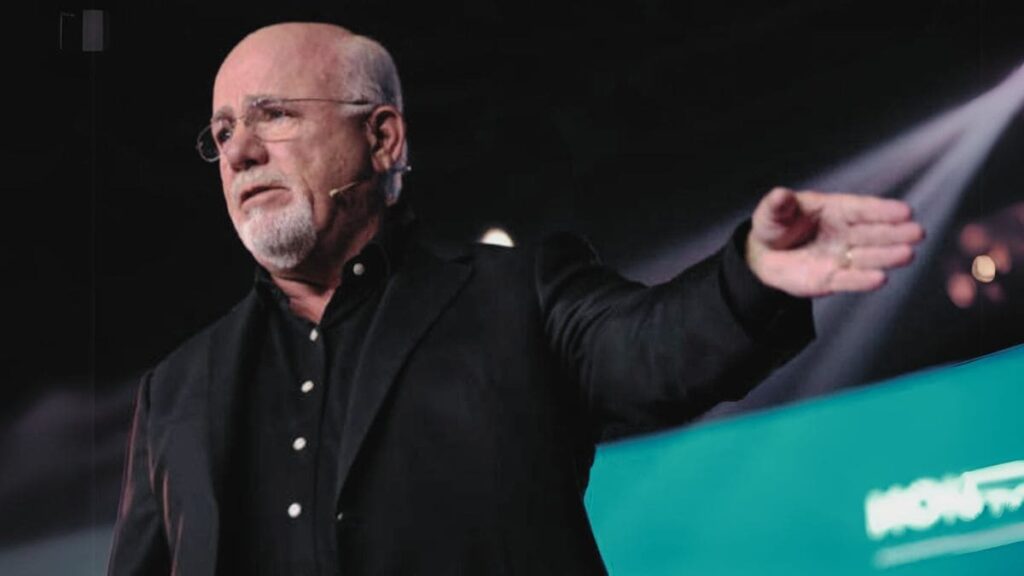

Dave Ramsey’s advice: start claiming social security at 62

Dave Ramsey, known for his firm and sometimes controversial opinions, advises that workers should begin withdrawing their Social Security at age 62. This recommendation contrasts with the stance of many financial experts who suggest waiting until 66 or 67 years old to maximize benefits. Despite the criticism, Ramsey stands by his advice, arguing that retiring at 62 offers significant advantages.

Reasons why Dave Ramsey recommends claiming at 62

- Access to money early: Ramsey believes that starting to claim Social Security at 62 allows individuals to access their money earlier and begin enjoying the rewards of their work.

- Early investment opportunity: He suggests that instead of waiting for potentially higher benefits later, it’s more prudent to withdraw the money early and reinvest it. This strategy could generate financial growth that might surpass the additional benefits gained by waiting until 66 or 70 years old.

- Greater financial flexibility: According to Ramsey, having money available at a younger age provides greater flexibility to make financial decisions, such as investing in mutual funds that could offer higher returns.

Is it always advisable to follow this advice?

While Ramsey’s proposal sounds appealing, financial experts warn of the risks. Investing Social Security money can be advantageous, but only if you have the necessary experience or access to qualified professional advice. Otherwise, the risk of loss might outweigh the potential benefits.

It’s crucial to understand that each person’s financial situation is unique. What works for some might not be the best option for others. Therefore, while Ramsey’s advice might be useful in certain cases, the final decision should depend on an individual assessment of one’s financial situation and long-term goals.